Setmasters have been building collators since 1975 and there are thousands of our machines in operation around the world.

Search Landing Page

Home / All Used Collators

If you purchase one of our used collators as a fixed asset for say £25,000 and have not used up AIA thresholds in the year (£1million), then your company would obtain 100% tax relief on the asset machine. Under the current corporation tax regime with effect from 1 April 2023, this would effectively reduce your tax bill by £4,750. That means whatever the purchase cost there is effectively a 19% contribution by the Government at the end of your tax year.

Products Listing

COLLATOR

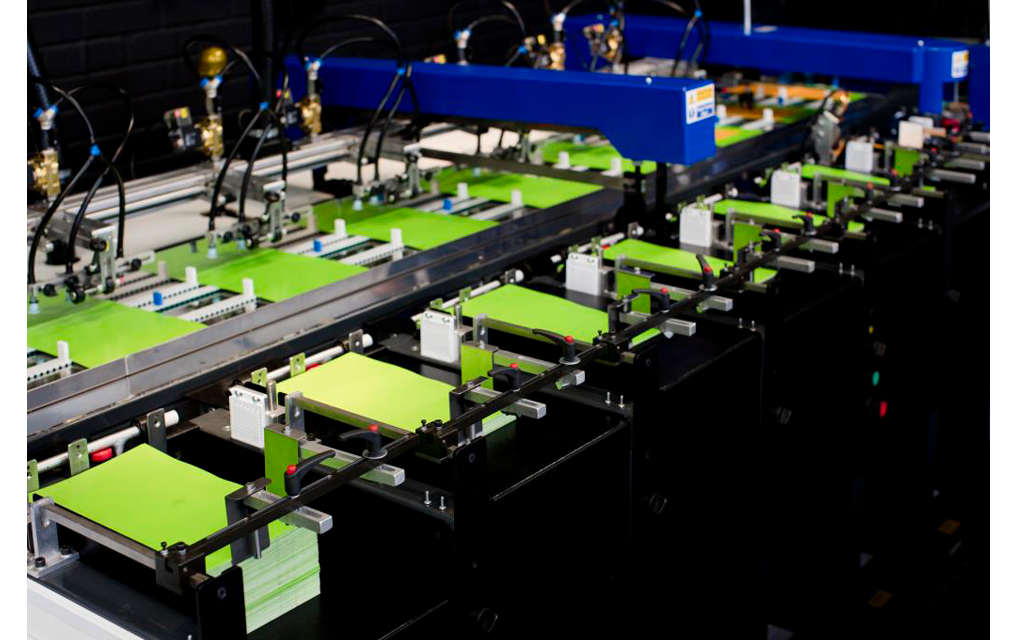

13/26 Station B3/A4 Duplex

This machine is available with a full as new 12 months warranty for all parts (mechanical and electrical).

COLLATOR

8 station B2 Portrait Collator

This machine is available with a full as new 12 months warranty for all parts (mechanical and electrical).

COLLATOR

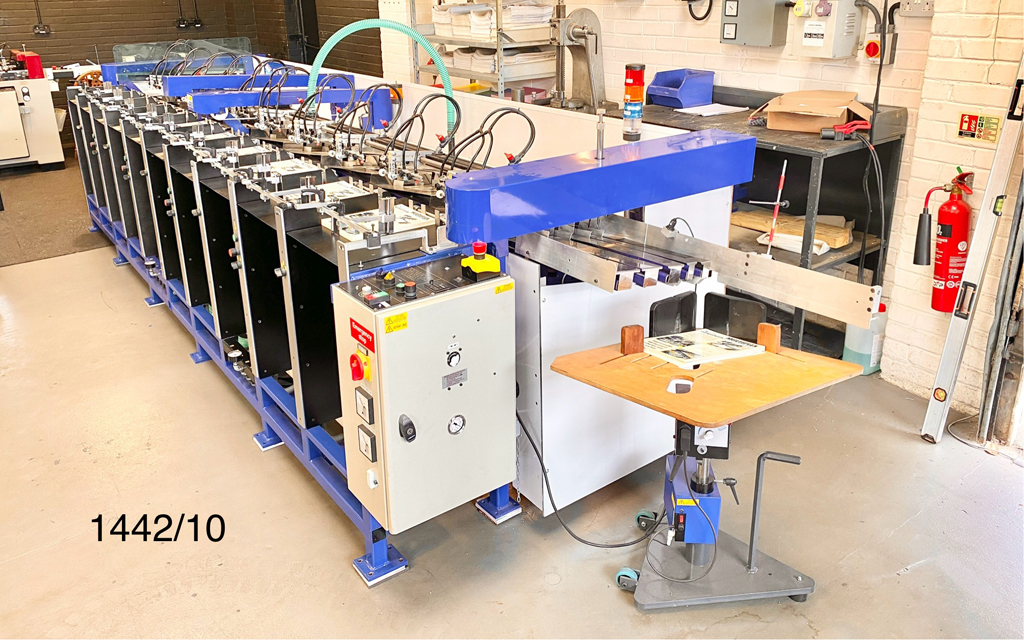

10/20 station SRA3/A4 Duplex Collator

This machine would suit a wide variety of applications collating materials from 20 to 800 gms.

COLLATOR

6 Station Signature (350 x 350mm) Deep Pile Feeder Collator

This machine is available for immediate delivery with a rental option if that proves more suitable.

COLLATOR

6/12 Station B2/A3 Duplex Collator

This machine due to its larger format and number of stations is well suited to a variety of work including calendar production

COLLATOR

15/30 Station B3/A4 Duplex Collator

Very flexible specification and machine is suitable for both flat sheet and folded section work

COLLATOR

7/14 Station SRA3/A4 Duplex Collator

This machine is available for immediate delivery and ideally suited to a wide range of applications.

COLLATOR

10-station Signature 35 cm x 35 cm Collator

A mix of deep and standard pile feeders, this machine is ideally suited to collation of folded sections. Option for an in-line offset stacking delivery conveyor turns this into a single operator machine

COLLATOR

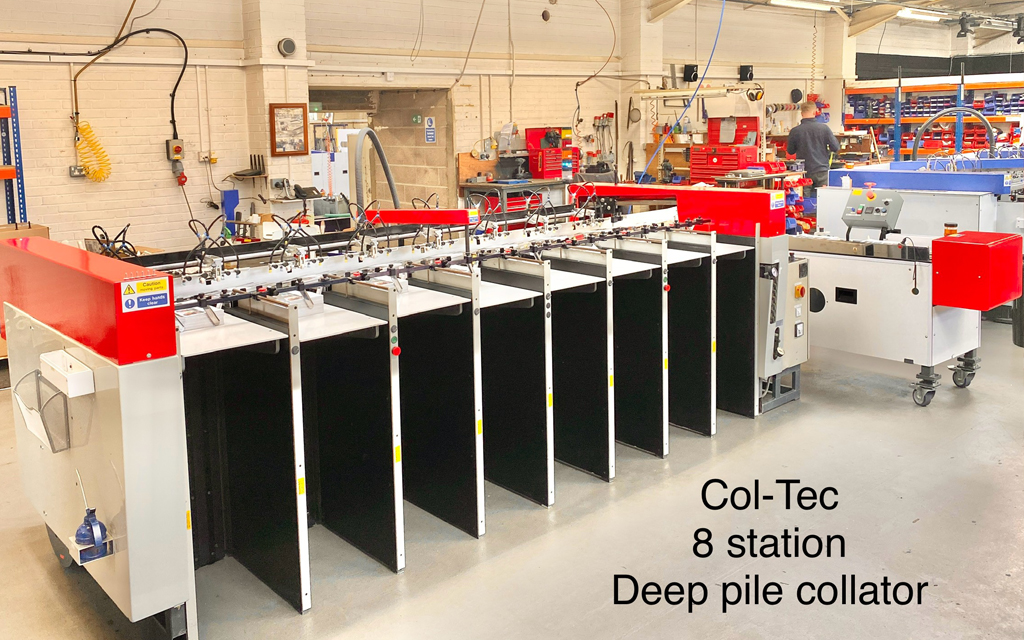

8 station Deep Pile Signature Collator

This machine ideally suits the collation of folded sections and any smaller stocks from A4 to A6 formats. In-line offset stacking delivery conveyor can be added.

COLLATOR

6 Station SRA4 Portrait Collator

This machine is available for demonstration and ideally suited to handling small product items.